The Integrity Council for the Voluntary Carbon Market is celebrating a significant milestone as the first three carbon credit programs have been assessed and found to adhere to the Carbon Core Principles criteria. This achievement marks a pivotal moment for the sector, signaling a “new chapter” for the voluntary carbon market.

With the approval granted, these pioneering carbon credit programs will now be able to display independently-approved integrity labels on the CO2 credits they sell. This development is crucial in enhancing business confidence within the market and addressing concerns surrounding ‘greenwashing. By providing transparency and assurance regarding the integrity of carbon credits, these integrity labels play a vital role in fostering trust among market participants and stakeholders.

This initiative represents a proactive step towards promoting accountability and credibility within the voluntary carbon market. By upholding rigorous standards and ensuring adherence to established principles, the Integrity Council is actively working to elevate the integrity of carbon credit programs and enhance the effectiveness of carbon offsetting initiatives.

The Integrity Council for the Voluntary Carbon Market (ICVCM) today announced that carbon credit project assessors Gold Standard, Climate Action Reserve (CAR) and ACR – which together cover almost 30 per cent of credits on the market – have all been approved as adhering to its Carbon Core Principles (CCPs) criteria.

First established last year in a bid to provide an industry-wide rulebook for the carbon credit market, the CCPs have been designed and approved by a range of experts in a bid to try and define what a high-integrity carbon credit looks like.

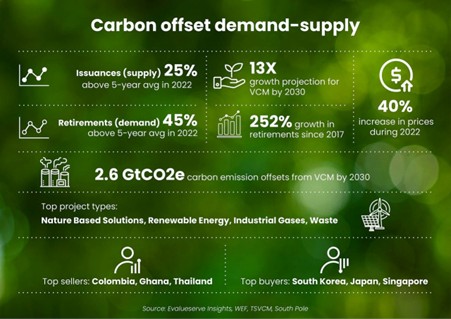

The CCP accreditation process forms a critical pillar of efforts to boost confidence in the voluntary carbon market (VCM) among companies and investors following a number of high-profile allegations of ‘junk’ carbon credits being sold.

Businesses have increasingly faced challenges in navigating the market – which has become flooded with a huge array of differing carbon credit standards bodies – and for ensuring the credits they purchase deliver the environmental, carbon and social benefits promised.

Proponents of carbon credits argue they offer a key means of attracting much-needed private investment into nature-based and technological carbon removals projects, while helping companies and organisations to meet their corporate net zero emissions targets.

But with the market having faced heavy criticism over allegations of ‘greenwashing’ and ‘junk’ credits being sold, pressure has mounted on the sector to improve its governance and standards, with experts and industry stakeholders warning 2024 may mark a “determining year” for the market as to whether it manages to overcome these reputational challenges.

But Annette Nazareth, chair of ICVCM’s independent Integrity Council, said the first batch of CCP label decisions announced today signalled the start of “a new chapter for the voluntary carbon market”.

The CCPs set a global benchmark for high-integrity, building trust, increasing standardisation and making it easy for buyers to identify high-integrity carbon credits,” she said. This will help mobilise private capital at scale for projects to reduce and remove billions of tonnes of emissions that would not otherwise be viable and will channel investment to the Global South.

Today’s announcement means that Gold Standard, CAR and ACR have all been judged by ICVCM’s expert council to have met the criteria and are now eligible to use the CCP label on the carbon credits they offer to buyers.

ICVCM said the three had made “a number of changes” in order to comply with the CCP criteria, which sets out expectations on governance, transparency, tracking and robust independent third-party validation and verification for accrediting carbon credit projects.

The criteria also includes rules on the robust quantification of CO2 reductions and removals, the avoidance of ‘double counting’ of CO2 reductions achieved, and on sustainable development benefits and safeguards.

Meanwhile, ICVCM also confirmed today that it is moving forward with assessing the next batch of carbon credit programmes which have applied for CCP accreditation – including Verra, ART, Social Carbon and Isometric – with the final decisions expected “in April or at the latest in May.

Gold Standard’s CEO Margaret Kim said she was “delighted” to have secured CCP eligibility.

Building the integrity of the carbon market so it can deliver real impact where it is needed most is vital, and the CCPs represent an important step on this journey,” she added. As a pioneer of the inclusion of sustainable development and safeguarding in carbon crediting, we will continue to demonstrate integrity and innovate with our partners to deliver a just transition towards global net zero, maximising sustainable development for the communities we serve.

The ICVCM was born out of a Mark Carney-led initiative aimed at developing more robust standards and greater transparency over carbon sequestering projects enabled through the VCM in the hopes of building it into a $100bn market. It is separate to the similarly-named Voluntary Carbon Markets Integrity Initiative, which aims to develop standards to improve the integrity of claims that companies and organisations themselves make when investing in CO2 credits.

The ICVCM also confirmed today that its Integrity Council is separately assessing more than 100 methodologies – the rules that carbon crediting programmes set for designing and implementing different categories of projects, from cookstoves to tree planting and clean energy – against CCP criteria, with the first decisions expected over the next two months.

The ICVCM expert group – which comprises an array of environmental experts and industry stakeholders in the VCM – has also been working to group various carbon credit methodologies into 36 different categories, depending on what type of project they support.

By September, ICVCM said it expected to have largely completed assessment of methodologies covering more than half of the volume of carbon credits issued on the market, including jurisdictional REDD projects, efficient cookstoves, and new methodologies expected to rapidly gain market share, such as biochar.

Once these methodologies are approved, the first CCP-labelled carbon credits are then set to appear on the market, with the volume of available accredited credits expected to then grow steadily over the remained of the year, according to ICVCM.

Amy Merrill, interim COO of the ICVCM’s Integrity Council, said she was “aware of market expectations and the urgency of introducing the CCP label to the market.

However, it is critical to restoring trust in the VCM that we take the time needed to get this right,” she said. “The methodologies we are assessing are complex, and consistency and care are essential.”

However, Simon Turek, managing director of carbon credit specialist PNZ Carbon, warned that businesses should not rely on CCP labels alone to judge quality of the carbon credits they seek to purchase.

The ICVCM’s first decisions under the CCPs should be welcomed – it helps raise the bar for quality in the voluntary carbon market, which is vital after a year in which trust has been damaged and confidence diminished,” he explained. However, this is just one small step forward in developing a full integrity framework, and businesses should not rely on CCP labels alone to judge quality. Many small projects with unique methodologies have not been assessed, and to rely solely on CCPs could halt the flow of capital into some of the world’s most effective and environmentally impactful projects.”