The advent of new mandatory emissions trading programs and growing consumer pressure have driven companies to turn to the voluntary market for carbon offsets. Changing public attitudes on climate change and carbon emissions have added a public policy incentive. Despite an ever-shifting background of state, federal, and international regulations, there’s more need than ever for companies and investors to understand carbon credits.

This guide will introduce you to carbon credits and outline the current state of the market. It will also explain how credits and offsets work in currently existing frameworks and highlight the potential for growth.

1. Carbon Credits, Offsets and Markets – An Introduction

The Kyoto Protocol of 1997 and the Paris Agreement of 2015 were international accords that laid out international CO2 emissions goals. With the latter ratified by all but six countries, they have given rise to national emissions targets and the regulations to back them.

With these new regulations in force, the pressure on businesses to find ways to reduce their carbon footprint is growing. Most of today’s interim solutions involve the use of the carbon markets.

What the carbon markets do is turn CO2 emissions into a commodity by giving it a price.

These emissions fall into one of two categories: Carbon credits or carbon offsets, and they can both be bought and sold on a carbon market. It’s a simple idea that provides a market-based solution to a thorny problem.

2. What are carbon credits and carbon offsets?

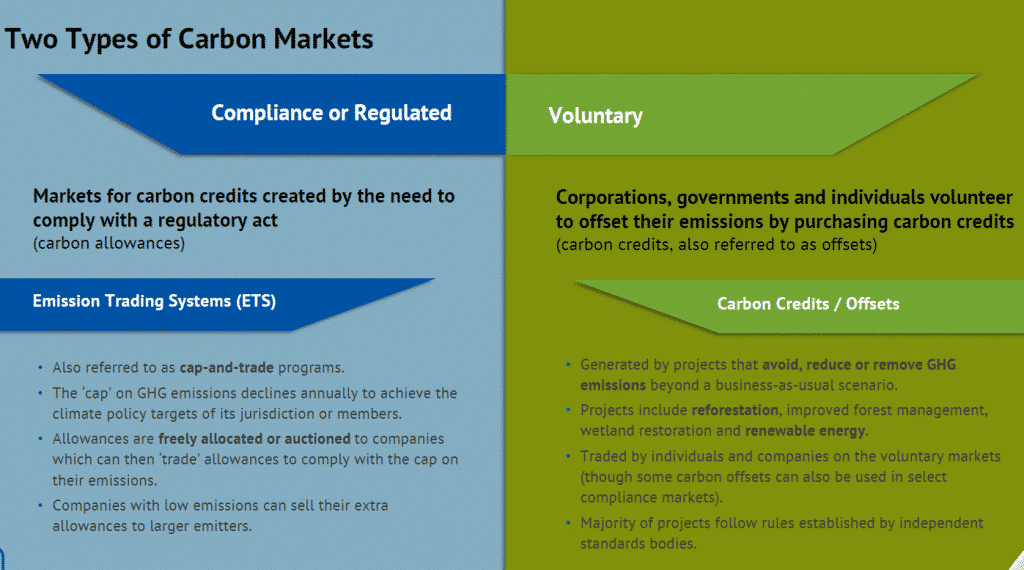

The terms are frequently used interchangeably, but carbon credits and carbon offsets operate on different mechanisms.

Carbon credits, also known as carbon allowances, work like permission slips for emissions. When a company buys a carbon credit, usually from the government, they gain permission to generate one ton of CO2 emissions. With carbon credits, carbon revenue flows vertically from companies to regulators, though companies who end up with excess credits can sell them to other companies.

Offsets flow horizontally, trading carbon revenue between companies. When one company removes a unit of carbon from the atmosphere as part of their normal business activity, they can generate a carbon offset. Other companies can then purchase that carbon offset to reduce their own carbon footprint.

Note that the two terms are sometimes used interchangeably, and carbon offsets are often referred to as “offset credits”. Still, this distinction between regulatory compliance credits and voluntary offsets should be kept in mind.

3. How are carbon credits and offsets created?

Credits and offsets form two slightly different markets, although the basic unit traded is the same – the equivalent of one ton of carbon emissions, also known as CO2e.

It’s worth noting that a ton of CO2 does refer to a literal measurement of weight. Just how much CO2 is in a ton?

- The average American generates 16 tons of CO2e a year through driving, shopping, using electricity and gas at home, and generally going through the motions of everyday life.

To further put that emission in perspective, you would generate one ton of CO2e by driving your average 22 mpg car from New York to Las Vegas.

Carbon credits are issued by national or international governmental organizations. We’ve already mentioned the Kyoto and Paris agreements which created the first international carbon markets.

In the U.S., California operates its own carbon market and issues credits to residents for gas and electricity consumption.

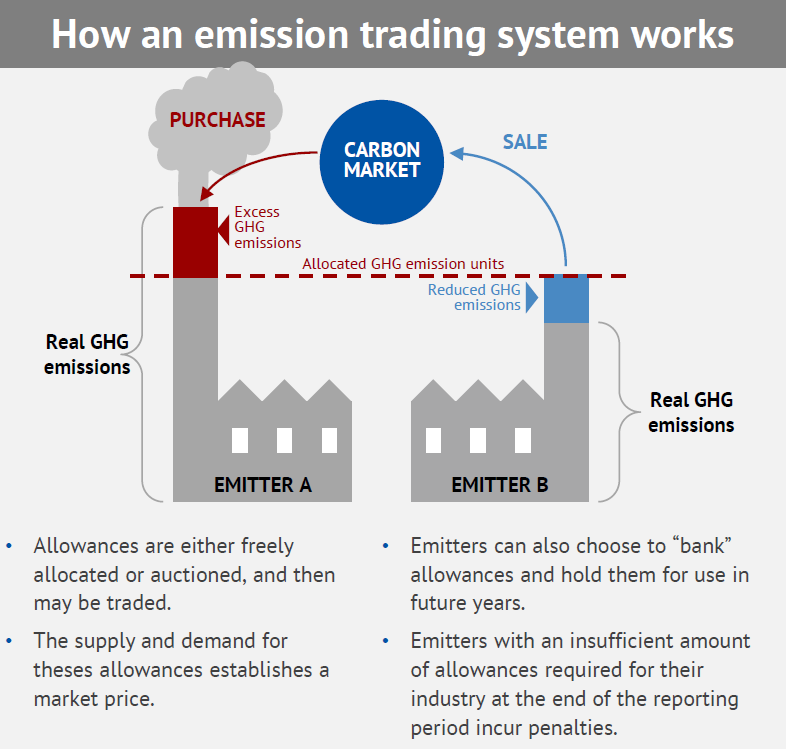

The number of credits issued each year is typically based on emissions targets. Credits are frequently issued under what’s known as a “cap-and-trade” program. Regulators set a limit on carbon emissions – the cap. That cap slowly decreases over time, making it harder and harder for businesses to stay within that cap.

Around the world, cap-and-trade programs exist in some form in Canada, the EU, the UK, China, New Zealand, Japan, and South Korea, with many more countries and states considering implementation.

Companies are thus incentivized to reduce the emissions their business operations produce to stay under their caps.

In essence, a cap-and-trade program lessens the burden for companies trying to meet emissions targets in the short term, and adds market incentives to reduce carbon emissions faster.

Carbon offsets work slightly differently…

Organizations with operations that reduce the amount of carbon already in the atmosphere, say by planting more trees or investing in renewable energy, have the ability to issue carbon offsets. The purchase of these offsets is voluntary, which is why carbon offsets form what’s known as the “Voluntary Carbon Market”. However, by buying these carbon offsets, companies can measurably decrease the amount of CO2e they emit even further.

4. What is the carbon marketplace?

When it comes to the sale of carbon credits within the carbon marketplace, there are two significant, separate markets to choose from.

- One is a regulated market, set by “cap-and-trade” regulations at the regional and state levels.

- The other is a voluntary market where businesses and individuals buy credits (of their own accord) to offset their carbon emissions.

Think of it this way: the regulatory market is mandated, while the voluntary market is optional.

When it comes to the regulatory market, each company operating under a cap-and-trade program is issued a certain number of carbon credits each year. Some of these companies produce less emissions than the number of credits they’re allotted, giving them a surplus of carbon credits.

On the flip side, some companies (particularly those with older and less efficient operations) produce more emissions than the number of credits they receive each year can cover. These businesses are looking to purchase carbon credits to offset their emissions because they must.

Most major companies are doing their part and will or have announced a blueprint to minimize their carbon footprint. However, the amount of carbon credits allocated to them each year (which is based on each business’s size and the efficiency of their operations relative to industry benchmarks)., may not be enough to cover their needs.

Regardless of technological advances, some companies are years away from reducing their emissions substantially. Yet, they still have to keep providing goods and services in order to generate the cash they need to improve the carbon footprint of their operations.

As such, they need to find a way to offset the amount of carbon they’re already emitting.

Here’s an example:

Let’s say two companies, Company 1 and Company 2, are only allowed to emit 300 tons of carbon.

However, Company 1 is on track to emit 400 tons of carbon this year, while Company 2 will only be emitting 200 tons.

To avoid a penalty comprised of fines and extra taxes, Company 1 can make up for emitting 100 extra tons of CO2e by purchasing credits from Company 2, who has extra emissions room to spare due to producing 100 tons less carbon this year than they were allowed to.

The Difference between the Voluntary and Compliance Markets

The voluntary market works a bit differently. Companies in this marketplace have the opportunity to work with businesses and individuals who are environmentally conscious and are choosing to offset their carbon emissions because they want to. There is nothing mandated here.

It might be an environmentally conscious company that wants to demonstrate that they’re doing their part to protect the environment. Or it can be an environmentally conscious person who wants to offset the amount of carbon they’re putting into the air when they travel.

- For example: in 2021, the oil giant Shell announced the company aims to offset 120 million tonnes of emissions by 2030

Regardless of their reasoning, companies are looking for ways to participate – and the voluntary carbon market is a way for them to do just that.

Both the regulatory and voluntary marketplaces complement one another in the professional (and the personal) world. They also make the pool of buyers more accessible to farmers, ranchers, and landowners – those whose operations can often generate carbon offsets for sale.

4.1 Top Carbon Companies (Stocks, ETFs)

We list out the top 4 carbon companies of 2023 to watch in this article here. These are arguably the best carbon stocks with world class assets or management teams. We also have a list of highly curated companies to watch out for on our Stocks Watchlist page here.

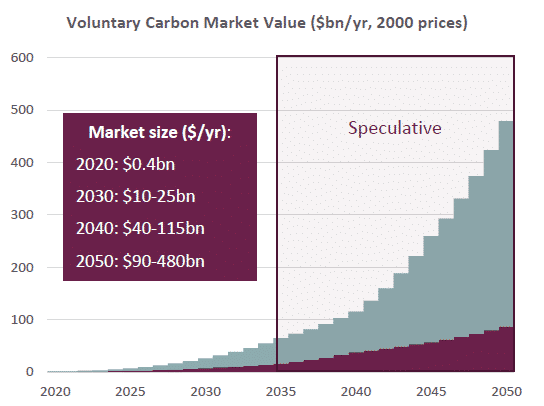

5. Overall size of carbon offset markets

The voluntary carbon market is difficult to measure. The cost of carbon credits varies, particularly for carbon offsets, since the value is linked closely to the perceived quality of the issuing company. Third-party validators add a level of control to the process, guaranteeing that each carbon offset actually results from real-world emissions reductions, but even so there’s often disparities between different types of carbon offsets.

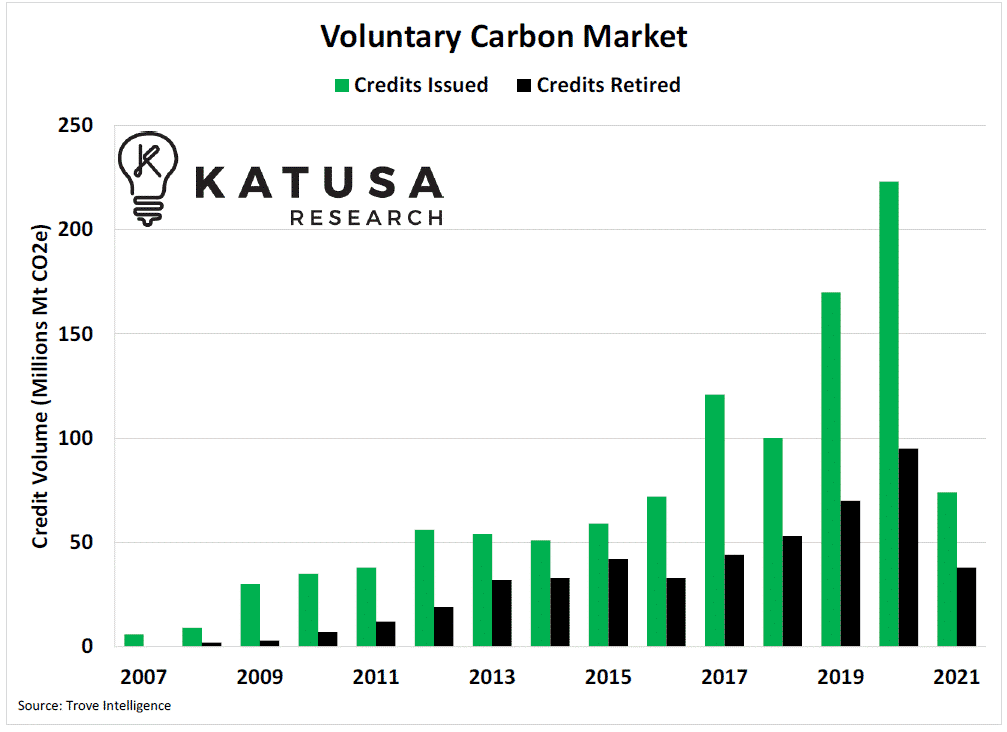

While the voluntary carbon market was estimated to be worth about $400 million last year, forecasts place the value of the sector between $10-25 billion by 2030, depending on how aggressively countries around the world pursue their climate change targets.

Despite the difficulties, analysts agree that participation in the voluntary carbon market is growing rapidly. Even at the rate of growth depicted above, the voluntary carbon market would still fall significantly short of the amount of investment required for the world to fully meet the targets set out by the Paris Agreement.

6. How to produce carbon credits

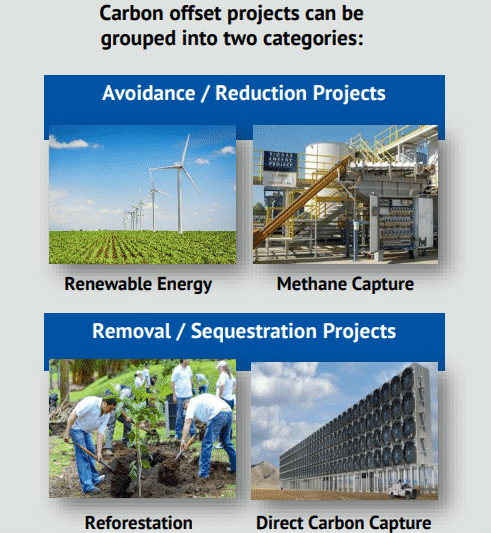

Many different types of businesses can create and sell carbon credits by reducing, capturing, and storing emissions through different processes.

Some of the most popular types of carbon offsetting projects include:

- Renewable energy projects,

- Improving energy efficiency,

- Carbon and methane capture and sequestration

- Land use and reforestation.

Renewable energy projects have already existed long before carbon credit markets came into vogue. Many countries in the world are blessed with a natural wealth of renewable energy resources. Countries such as Brazil or Canada that have many lakes and rivers, or nations like Denmark and Germany with lots of windy regions. For countries like these, renewable energy was already an attractive and low-cost source of power generation, and they now provide the added benefit of carbon offset creation.

Energy efficiency improvements complement renewable energy projects by reducing the energy demands of current buildings and infrastructure. Even simple everyday changes like swapping your household lights from incandescent bulbs to LED ones can benefit the environment by reducing power consumption. On a larger scale, this can involve things like renovating buildings or optimizing industrial processes to make them more efficient, or distributing more efficient appliances to the needy.

Carbon and methane capture involves implementing practices that remove CO2 and methane (which is over 20 times more harmful to the environment than CO2) from the atmosphere.

Methane is simpler to deal with, as it can simply be burned off to create CO2. While this sounds counterproductive at first, since methane is over 20 times more harmful to the atmosphere than CO2, converting one molecule of methane to one molecule of CO2 through combustion still reduces net emissions by more than 95%.

For carbon, capture often happens directly at the source, such as from chemical plants or power plants. While the injection of this captured carbon underground has been used for various purposes like enhanced oil recovery for decades already, the idea of storing this carbon long-term, treating it much like nuclear waste, is a newer concept.

Land use and reforestation projects use Mother Nature’s carbon sinks, the trees and soil, to absorb carbon from the atmosphere. This includes protecting and restoring old forests, creating new forests, and soil management.

Plants convert CO2 from the atmosphere into organic matter through photosynthesis, which eventually ends up in the ground as dead plant matter. Once absorbed, the CO2 enriched soil helps restore the soil’s natural qualities – enhancing crop production while reducing pollution.

6.1 Who verifies carbon credits?

Visit our article here on how carbon credits are verified by the market.

7. How companies can offset carbon emissions

There are countless ways for companies to offset carbon emissions.

Though not a comprehensive list, here are some popular practices that typically qualify as offset projects:

- Investing in renewable energy by funding wind, hydro, geothermal, and solar power generation projects, or switching to such power sources wherever possible.

- Improving energy efficiency across the world, for instance by providing more efficient cookstoves to those living in rural or more impoverished regions.

- Capturing carbon from the atmosphere and using it to create biofuel, which makes it a carbon-neutral fuel source.

- Returning biomass to the soil as mulch after harvest instead of removing or burning. This practice reduces evaporation from the soil surface, which helps to preserve water. The biomass also helps feed soil microbes and earthworms, allowing nutrients to cycle and strengthen soil structure.

- Promoting forest regrowth through tree-planting and reforestation projects.

- Switching to alternate fuel types, such as lower-carbon biofuels like corn and biomass-derived ethanol and biodiesel.

If you’re wondering how carbon offset and allotment levels are valued and determined through these processes, take a deep breath. Monitoring emissions and reductions can be a challenge for even the most experienced professional.

However, be careful when shopping online or directly from other businesses – not all offset projects are certified by appropriate third parties, and those that aren’t, generally tend to be of dubious quality.

8. Voluntary vs Compulsory: The biggest difference between credits and offsets

Participation in a cap-and-trade scheme typically isn’t voluntary. Your company either needs to abide by carbon credit limits set by regulators, or no such limits exist. As more and more countries adopt cap-and-trade programs, companies increasingly need to participate in carbon credit programs.

Carbon credits intentionally add an extra onus to businesses. In return, the best cap-and-trade programs provide a clear framework for reducing carbon emissions. Not all programs are created equal, of course, but at their best, carbon credits have a clear impact on total carbon emissions.

There’s no regulation that mandates companies to purchase carbon offsets. Doing so is going above and beyond, particularly for companies operating where cap-and-trade programs don’t exist yet. Precisely for that reason, offsets provide a few advantages that credits simply don’t.

9. The Two Types of Global Carbon Markets: Voluntary and Compliance

There’s one more important distinction between carbon credits and carbon offsets:

- Carbon credits are generally transacted in the carbon compliance market.

- Carbon offsets are generally transacted in the voluntary carbon market.

Global Compliance Market

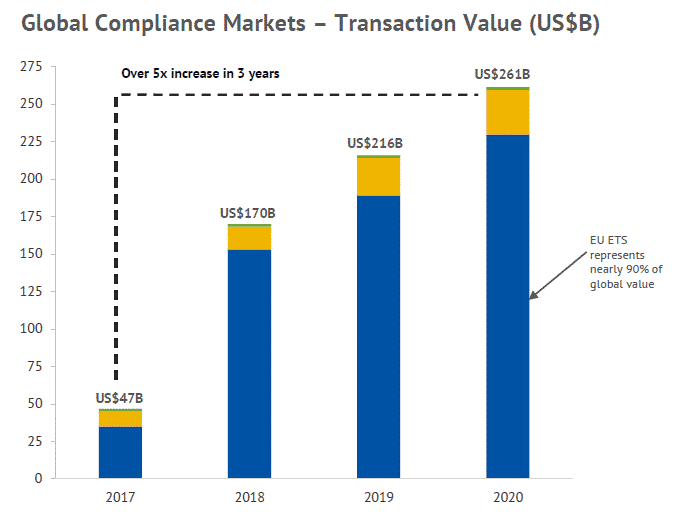

The global compliance market for carbon credits is massive. According to Refinitiv the total market size is US$261 billion, representing 10.3Gt CO2 equivalent traded on the compliance markets in 2020.

Mandatory schemes limiting the amount of greenhouse gases that can be emitted have proliferated—and with them, a fragmented carbon compliance market is developing. For example, the European Union has an Emissions Trading System (ETS) that enables companies to buy carbon credits from other companies.

California runs its own cap-and-trade program, and nine states on the eastern seaboard have formed their own cap-and-trade conglomerate, the Regional Greenhouse Gas Initiative.

Companies with low emissions can sell their extra allowances to larger emitters in a compliance market.

The Voluntary Carbon Market

The voluntary carbon market for offsets is smaller than the compliance market, but expected to grow much bigger in the coming years. It’s open to individuals, companies, and other organizations that want to reduce or eliminate their carbon footprint, but are not necessarily required to by law.

Consumers can purchase offsets for emissions from a specific high-emission activity, such as a long flight, or buy offsets on a regular basis to eliminate their ongoing carbon footprint.

The voluntary carbon market is where many companies like Apple, Stripe, Shell and British Petroleum are actively seeking to offset their footprint. It’s the sector most ripe for growth.

10. Corporate Social Responsibility (CSR)

Consumers are increasingly aware of the importance of carbon emissions. Consequently, they’re increasingly critical of companies that don’t take climate change seriously. By contributing to carbon offset projects, companies signal to consumers and investors that they’re paying more than just lip service to combat climate change. For many companies, the CSR benefit can often outweigh the actual cost of the offset.

11. Opportunity to maximize impact

Not every carbon credit market is created equal, and it’s easy to find flaws even with tightly regulated programs like California’s. Carbon allowances in those markets might not actually be worth as much as they say on the tin, but since participation is mandatory, it’s hard for companies to control their own impact.

In theory, purchasing carbon offsets gives companies a more concrete way to reduce their carbon footprint. After all, carbon credits only deal with future emissions. But, carbon offsets let companies address even their historical emissions of CO2e right away.

Used correctly, carbon offsets are a way for companies to earn extra PR credit and achieve a more measurable reduction in carbon emissions. Since there’s no regulatory body overseeing carbon offsets, standards companies like Verra have become influential in vetting the carbon offsets market.

12. The offset advantage: New revenue streams

There’s one more big advantage of carbon offsets.

If you’re the company selling them, they can be a significant revenue stream! The best example of this is Tesla. Yes, that Tesla, the electric car maker, who sold carbon credits to legacy car manufacturers to the tune of $518 million in just the first quarter of 2021.

That’s a huge deal, and it’s single-handedly keeping Tesla out of the red. If the market for carbon credits continues to go up, and the pricing of credits keeps increasing, Tesla and other environmentally beneficial businesses could reap huge dividends.

13. Do carbon offsets actually reduce emissions?

Both offsets and credits don’t always work as intended. Voluntary carbon offsets rely on a clear link between the activity undertaken and the positive environmental impact.

Sometimes that link is obvious – companies that use carbon capture technology to remove CO2 emissions and lock them away can point to hard numbers.

Other programs, like offsets that promote green tourism or seek to offset the damage of international travel, can be more difficult to measure. The reputation of the organization issuing the credit determines the value of the offset. Reputable carbon offset organizations choose carbon projects carefully and report on them meticulously, and third-party auditors can help ensure such projects measure up to strict standards like those established by UN’s Clean Development Mechanism.

Once properly vetted, “high-quality” offsets represent tangible, measurable amounts of reductions in CO2e emissions that companies can use like they reduced their own greenhouse gas emissions themselves. Though the company has not yet actually reduced their own emissions, the world is just as well off as if the company had actually done so.

This way, the company has bought itself more time to make its operations more environmentally friendly, while as far as the atmosphere is concerned, they already have.

14. Can you purchase carbon offsets as an individual?

Unless you represent a large corporation, you’re unlikely to be able to purchase a carbon offset directly from the source company. For now.

Instead, you’ll need to turn to one of the growing number of third-party companies that function as intermediaries. While this may seem like an added step, these companies offer a few advantages.

The best ones also work as a verification mechanism. They vet and double-check to be sure that the carbon offsets you purchase are, well, actually offsetting carbon.

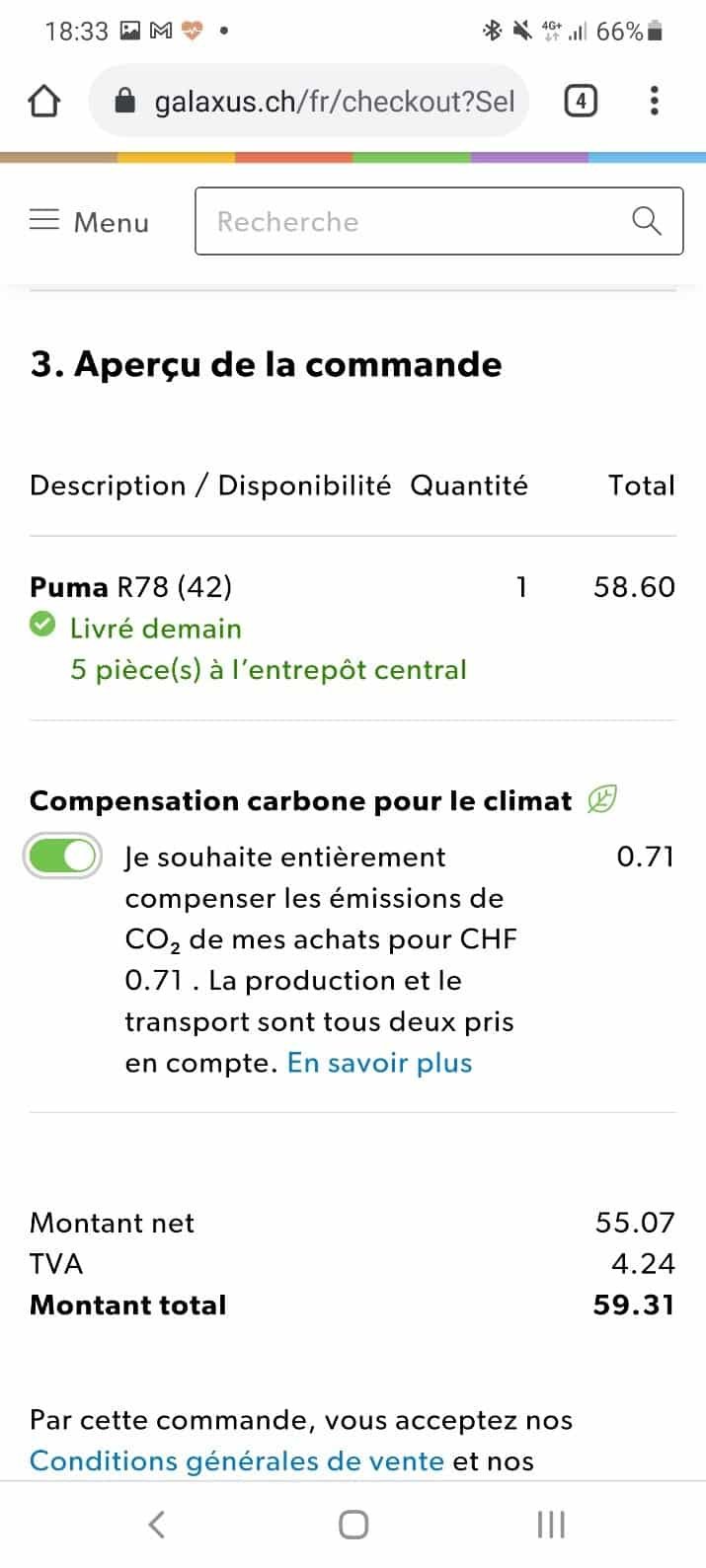

- For example: Companies such as Galaxus, which is Switzerland’s #1 online retailer, offers consumers the ability to offset the carbon footprint of their purchase.

Carbon Footprint Calculator

Many organizations will also provide a carbon footprint calculator. You can use these calculators to determine exactly how many carbon offsets you will need in order to be carbon neutral.

For many investors, carbon offsets are a way to minimize their own carbon footprint and live an environmentally friendly lifestyle. The size of the market and the growing demand for carbon offsets indicate that there’s serious potential for companies that produce carbon credits to see large-scale growth over the next decades.

15. Do I Need Carbon Offsets or Carbon Credits?

Now that you know their differences and what they have in common, here’s how carbon credits and carbon offsets work in the grand, global scheme of emissions reduction.

The government is putting heavy caps on greenhouse gas emissions, meaning that companies will have to reconfigure their operations to reduce emissions as much as possible. Those that cannot be eliminated will have to be accounted for through the purchase of carbon credits.

Ambitious organizations, corporations, and people can purchase carbon offsets to reach net zero or even nullify all previous historical emissions.

So which do you need?

If you’re a corporation, the answer might just be “both” — but it all depends on your business goals, as well as the local regulations where your company operates. If you’re a consumer, carbon credits are likely unavailable to you, but you can still do your part by purchasing carbon offsets.

Returning to the illustration from earlier, our vital, global goal is to both stop dumping chemicals into the metaphorical water supply, and to purify the existing water supply over time. In other words, we need to both drastically reduce CO2 emissions, and work to remove the CO2 currently in the atmosphere if we want to materially reduce pollution.

16. Why should I buy carbon credits?

If you’re a corporation, there are plenty of compelling reasons as to why you should be seriously considering investing in carbon credits and offsets.

If you’re an individual looking to buy carbon credits, you’re likely interested for one of two reasons:

The first reason is that you’re environmentally conscious, and looking to do your part in combatting climate change by offsetting your own greenhouse gas emissions, or those of your family.

If that’s the case, then rest assured – carbon offsets from a reputable vendor such as Native Energy are the perfect way for you to negate your own carbon footprint.

The second reason you’re interested in buying carbon credits is because you think it represents an investment opportunity. The global carbon market grew 20% last year and that strong growth is expected to continue as climate change becomes an increasingly relevant concern to the world at large.

If you fall into the latter category, then head over to our carbon investor centre, where we showcase some of the best investment opportunities in the carbon sector right now.

17. What is Blue Carbon?

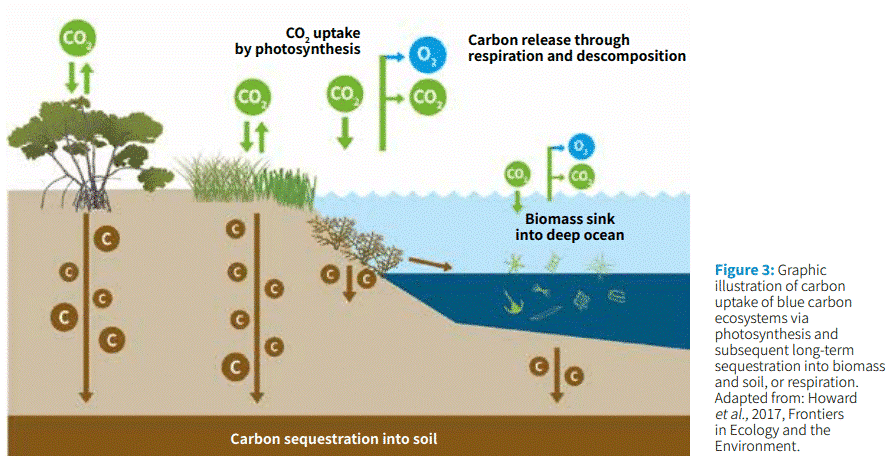

Blue Carbon are special carbon credits derived from sites known as blue carbon ecosystems. These ecosystems primarily feature marine forests, such as tidal marshes, mangrove forests and seagrass beds.

Yes, forests can grow in the ocean! Examples include the mangrove forests in sea bays, such as Magdalena Bay in Baja California Sur, Mexico.

Mangroves are trees (about 70 percent underwater, 30 percent above water) that have evolved to be able to survive in flooded coastal environments where seawater meets freshwater, and the resulting lack of oxygen makes life impossible for other plants.

- Key Fact: Mangroves cover just 0.1% of earth’s surface

Mangrove trees create shelter and food for numerous species such as sharks, whales, and sea turtles. And thanks to their other second-order effects such as the positive impacts on corals, algae and marine biodiversity that have been so negatively impacted by activities such as over-fishing and farming, mangroves are considered to be extremely valuable marine ecosystems.

Over the past decade scientists have discovered that blue carbon ecosystems like these mangrove forests are among the most intensive carbon sinks in the world.

This means that blue carbon offsets can remove enormous amounts of greenhouse gases relative to the amount of area they occupy. On top of that, they also provide a whole slew of other side benefits to their local ecosystems.

Accordingly, a blue carbon offset project will have its carbon offsets trade at a premium.

18. Second Order Effects of Blue Carbon Credits

Other positive second-order effects of mangrove forests include:

- Their importance as a pollution filter,

- Reducing coastal wave energy, and

- Reducing the impacts from coastal storms and extreme events.

Blue carbon systems also trap sediment, which supports root systems for more plants.

This accumulation of sediment over time can enable coastal habitats to keep pace with rising sea levels.

In addition, because the carbon is sequestered and stored below water in aquatic forests and wetlands, it’s stored for more than ten times longer than in tropical forests.

- The significant positive second-order effects attributed to each blue carbon credit are why many believe they will trade at a premium to other carbon credits.

Blue Carbon and the Food Footprint

There is a land-use carbon footprint of 1,440 kg CO2e for every kilogram of beef and 1,603 kg CO2e for every kilogram of shrimp produced on lands formerly occupied by mangroves. A typical steak and shrimp cocktail dinner would potentially burden the atmosphere with 816 kg CO2e if the ingredients were to come from such sources.

It’s estimated that over 1 billion tons of carbon dioxide is released annually from degrading coastal ecosystems.

There are around 14 million hectares of mangrove aquaforests on Earth today. And many are under attack by the deforestation practices caused by intense shrimp farming

Are the shrimp you eat part of the problem? Soon, these shrimps will be labeled, and consumers will know and be required to cover the offset costs for the environmental damage.

To put things into perspective, 14 million acres of wetlands would absorb as much carbon out of the atmosphere as if all of California and New York State were covered in tropical rainforest.

Think of blue carbon as the “high grade” gold mine at the surface.

Oceanic Blue Carbon

In addition to coastal blue carbon mentioned above, oceanic blue carbon is stored deep in the ocean within phytoplankton and other open ocean biota.

The infographic below shows the typical blue carbon ecosystem:

There are many factors that influence carbon capture by blue carbon ecosystems. These include:

- Location

- Depth of water

- Plant species

- Supply of nutrients

Improving blue carbon ecosystems can significantly improve the livelihoods and cultural practices of local and traditional communities. In addition, restoring blue carbon regions provides enormous biodiversity benefits to both marine and terrestrial species.