The carbon asset management market welcomes a major participant with the entry of Contemporary Green Energy (CGE), a subsidiary of Chinese battery technology giant CATL (Contemporary Amperex Technology).

CGE is renowned for its expertise in investments, construction, and operations within the new energy sector, with a specific emphasis on wind and solar energy. The company is dedicated to the storage and trading of green power, showcasing a strong commitment to promoting renewable energy sources.

Moreover, CGE offers comprehensive decarbonization services, ranging from consulting to implementing carbon reduction solutions for businesses. With its robust portfolio and focus on sustainability, CGE is poised to make a significant impact in the carbon asset management market.

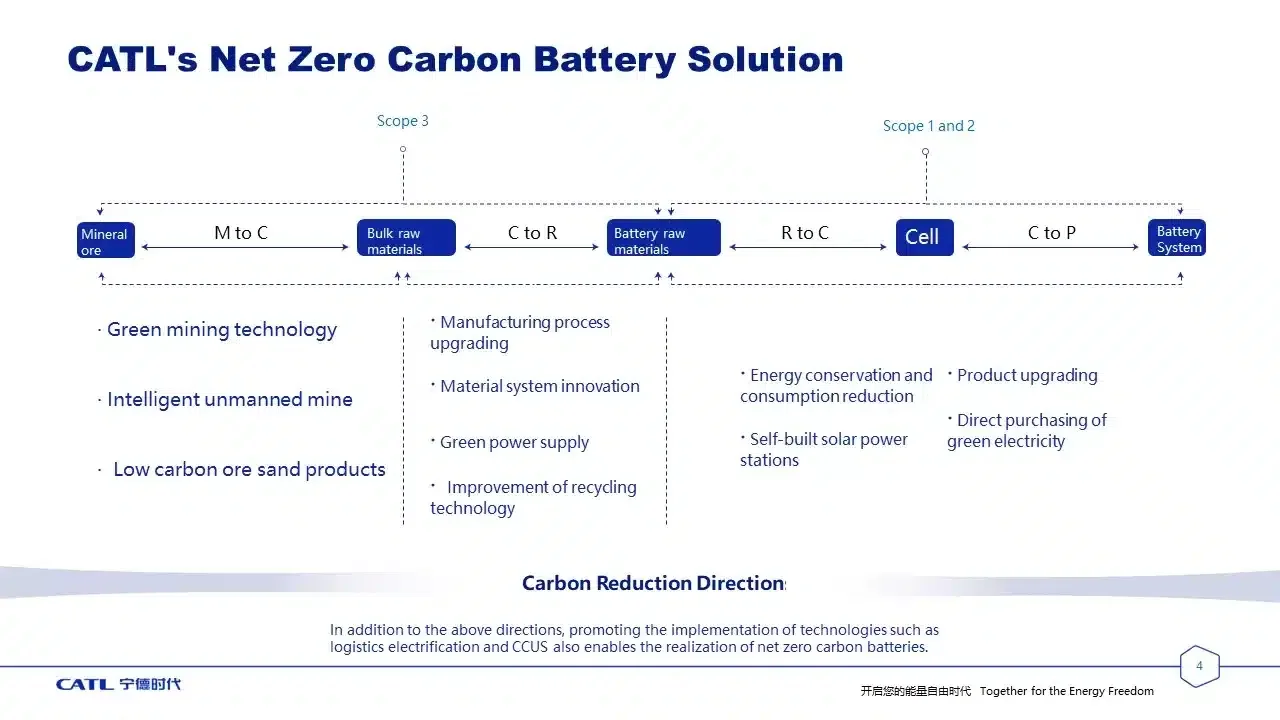

Bolstering CATL’s Carbon Reduction Matrix

The creation of a carbon asset management company appears to complement and strengthen CATL‘s existing carbon reduction tool matrix.

The term “carbon assets” refers to new assets generated by China’s national emissions trading scheme. These include various carbon emission quotas, also known as carbon credits, issued by the government and eligible carbon reduction projects, as defined by the China Securities Regulatory Commission (CSRC) industry standards.

The growing interest in carbon asset management is evident in the increasing number of players entering the market. Data shows over 4,800 carbon asset management-related companies in China, with more than 1,100 established in 2023 alone.

Industry experts believe that companies with significant carbon emissions and those engaged in the development or procurement of carbon assets handle substantial capital. Thus, the standardization, systematization, and optimization of carbon asset management become essential.

CATL reported Scope 1 and Scope 2 carbon emissions of 3.24 million tons in 2022, according to its environmental, social, and governance (ESG) report.

To meet Science Based Targets initiative (SBTi) requirements, CATL aims to reduce its carbon emissions by at least 90%. The leading lithium battery company will offset the remaining 10% by purchasing carbon credits to achieve operational carbon neutrality.

CATL announced plans last year to achieve carbon neutrality in its core operations by 2025 and across the value chain by 2035. This suggests significant challenges ahead in meeting carbon reduction targets over the next few years. The battery maker identified what it called 5 key links in its value chain where emissions will be cut:

- Mining

- Bulk raw materials

- Battery materials

- Cell manufacturing

- Battery systems

Given CATL’s scale, the annual expense on carbon credits for this purpose is expected to be substantial.

Given CATL’s scale, the annual expense on carbon credits for this purpose is expected to be substantial.

CATL’s EV Battery Dominance Amidst Challenges

The global leader in lithium battery production said that 2023 profit reaches $6.3 billion on strong battery sales.

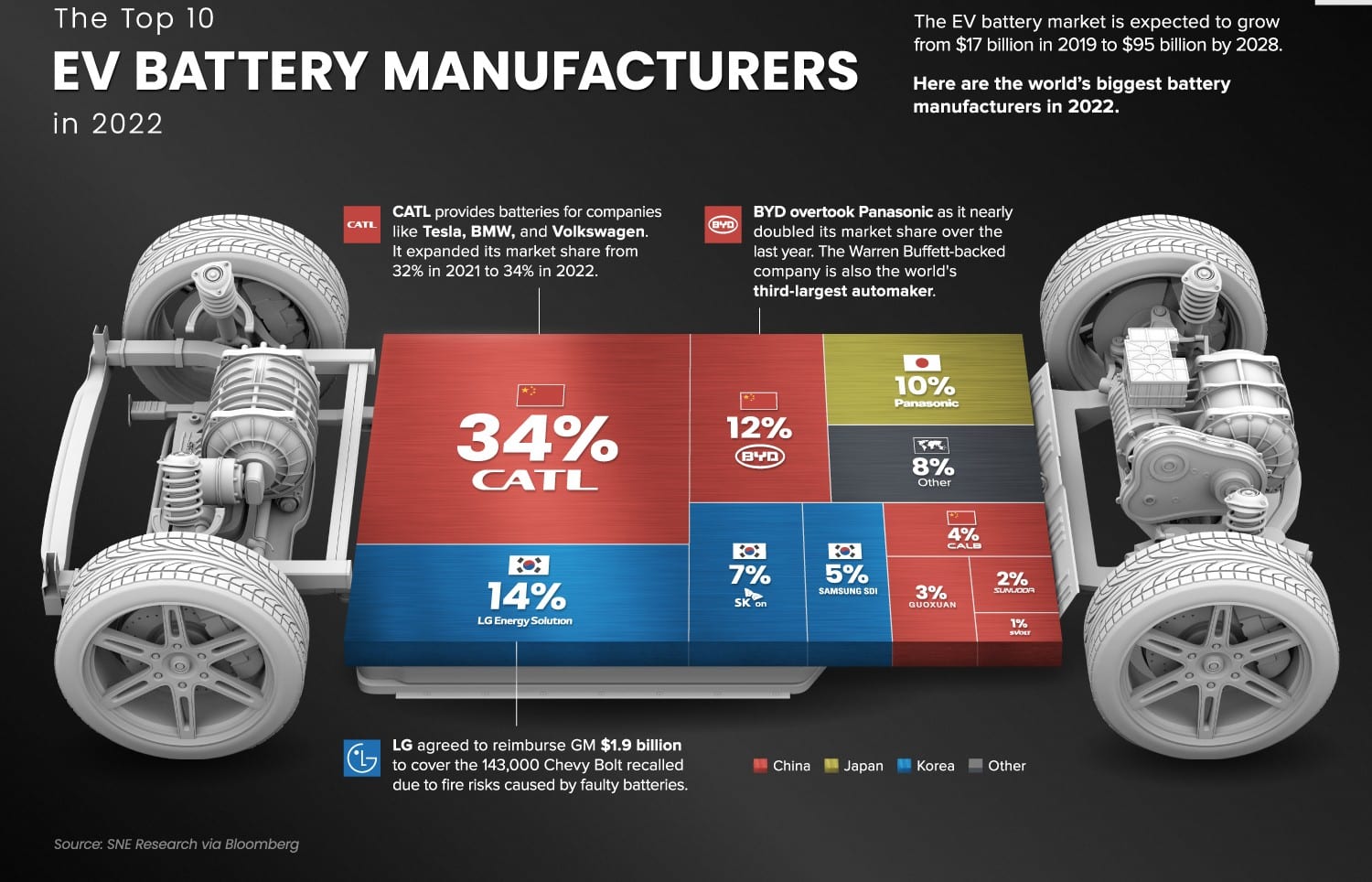

CATL continues to maintain a significant lead in battery manufacturing both globally and within China, the largest electric vehicle (EV) market in the world.

As of November 2023, CATL’s share of the global EV battery market increased to 37.4%, up from 36.9% in October, according to data from SNE Research Inc. BYD Co. held the second position with a market share of 15.7%, taking over LG’s 2nd place in 2022.

Despite its leading position, CATL faces headwinds as the momentum in EV sales begins to slow down.

Elon Musk’s Tesla reported Q4 2023 earnings that failed to meet expectations and cautioned about weaker sales growth in 2024. Additionally, both Volkswagen AG and Renault SA have scaled back their plans to sell shares in their EV businesses.

Similarly, EV production was down in China because of no more state subsidies, causing downward pressure on lithium prices. Lithium is the key element that powers up EV batteries.

Still, CATL remains hopeful on the market’s long-term forecasts, knowing that EV is essential for decarbonization efforts globally.

The same optimism is shared by battery-related companies abroad such as the junior Canadian lithium company, Li-FT Power (LIFT: LIFFF). The company focuses on advancing the exploration and development of high-quality lithium assets in North America.

CATL’s Carbon Asset Strategy

Due to current limitations in decarbonization technology, CATL must offset remaining carbon emissions by buying carbon credits. Establishing a dedicated carbon asset management company aims to rejuvenate carbon credits as assets and enhance their value preservation and appreciation.

Moving towards carbon asset management signifies more than just buying and selling; it involves actively reducing emissions to lower compliance costs, utilizing financial tools effectively, and optimizing resource allocation based on current carbon asset status.

For CATL, establishing a carbon asset management company is likely aimed at fulfilling its own needs. This is especially considering the pressure to reduce emissions following the European Union’s new battery regulation.

At CATL’s home, the carbon market in China has been rapidly expanding and upgrading, with the official restart of CCER in January after nearly 7 years. This expansion resulted in increased activity in carbon credit markets, creating opportunities for development within the carbon asset management sector.

CGE, with 54 subsidiaries, mostly involved in offshore wind power development, serves as a stable source of green power for CATL, presenting a crucial avenue for carbon emissions reduction.

Despite not belonging to the 8 major energy-consuming industries, CATL’s early engagement in carbon trading and its substantial resources position it as a formidable player in the carbon asset management market.

Disclosure: Owners, members, directors and employees of carboncredits.com have/may have stock or option position in any of the companies mentioned: LIFFF

Carboncredits.com receives compensation for this publication and has a business relationship with any company whose stock(s) is/are mentioned in this article

Additional disclosure: This communication serves the sole purpose of adding value to the research process and is for information only. Please do your own due diligence. Every investment in securities mentioned in publications of carboncredits.com involve risks which could lead to a total loss of the invested capital.