According to a recent report by the World Bank, several prominent global companies, including American video streaming company Netflix, technology giant Apple, and British oil multinational Shell, are actively participating in Kenya’s voluntary carbon market (VCM). This market, which operates outside of regulatory mandates, allows companies to voluntarily offset their carbon emissions by investing in projects that reduce greenhouse gas emissions or enhance carbon sequestration.

Netflix, Apple, and Shell’s involvement in Kenya’s VCM reflects a growing trend among corporations to take proactive steps towards mitigating their environmental impact and contributing to climate action. By participating in carbon credit programs and investing in sustainable projects in Kenya, these companies not only demonstrate their commitment to environmental responsibility but also support the country’s efforts to combat climate change and promote sustainable development.

The influx of global companies into Kenya’s carbon credit market signifies the increasing recognition of the importance of carbon offsetting as a viable strategy for achieving carbon neutrality and addressing climate change on a global scale. As more companies join the movement towards sustainability, the voluntary carbon market is expected to continue growing, providing opportunities for innovative climate solutions and driving positive environmental outcomes in Kenya and beyond.

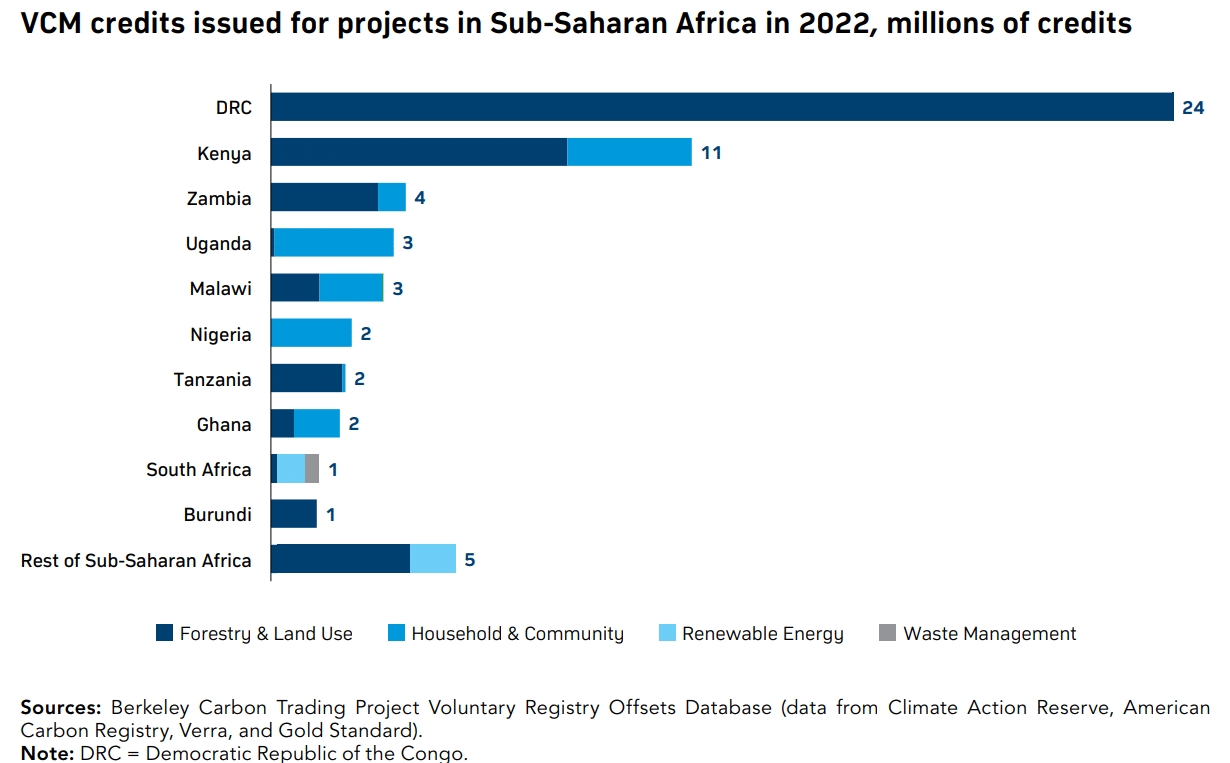

The report, titled ‘Carbon Market Guidebook for Kenyan Enterprises,’ reveals that in 2022, Kenya ranked as the second largest issuer of VCM carbon credits in Africa, trailing only the Democratic Republic of the Congo.

Since the launch of the African Carbon Markets Initiative (ACMI) in 2022, Africa’s huge carbon credit potential has been unlocked. ACMI aims to mobilize climate finance for the continent, focusing on clean energy access and sustainable development. By leveraging carbon markets, the ACMI directs funds to emissions reduction projects, addressing energy poverty and promoting renewable energy.

From Hollywood to Oil Fields: Big Players Enter Kenya’s Carbon Market

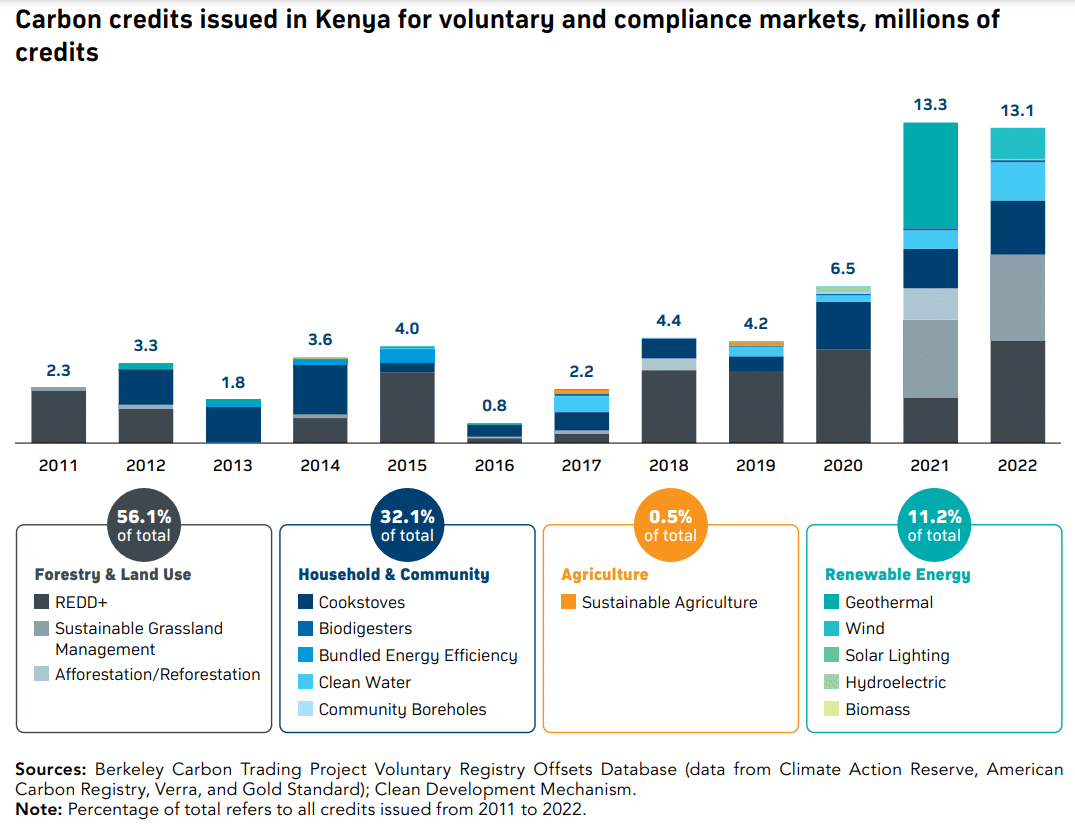

Since 2011, Kenya has issued over 59 metric tons of carbon credits to various projects. Eighty three percent of these credits come from voluntary markets.

Most of the voluntary carbon credits issued in Kenya stem from nature-based projects. However, the report further highlights that tech-based projects are beginning to emerge in the market.

In a carbon credit market, organizations and individuals purchase credits generated through emission reduction projects to offset their carbon footprint. Companies whose business operations pollute pay significant sums to support initiatives aimed at removing or absorbing CO2 from the atmosphere.

Each credit represents the reduction or removal of one tonne of CO2 from the air, often achieved through projects focused on combating deforestation, particularly in developing countries.

The primary purchasers of VCM credits in Kenya have been major corporations such as Netflix, Apple, Shell, Air France-KLM, BHP, Delta Air Lines, and Kering, the report notes. Other notable companies participating in Kenya’s carbon credits market include Nedbank from South Africa, Nespresso from Switzerland, and Zenlen Inc.

Unveiling Kenya’s Carbon Credit Landscape

The report highlights that most of the carbon credits generated from Kenya in voluntary markets have been attributed to forestry and land use projects. Specifically, these credits have been issued to four developers, three of which are based in Kenya:

- Wildlife Works Carbon,

- Chyulu Hills Conservation Trust, and

- Northern Rangelands Trust.

These organizations have contributed to carbon credit generation through initiatives aimed at reducing emissions from deforestation and forest degradation (REDD+). They also focus on implementing sustainable grassland management projects to support local environmental conservation efforts.

Additionally, household and community-based credits, particularly those related to cookstoves, represent another significant type of credit generated in the country.

However, there’s limited transparency regarding the prices paid for these credits. They have primarily been sold through bilateral negotiations over the counter, making it challenging to determine the exact prices. The enterprises responsible for these credits are more fragmented and often rely on carbon credit revenue to achieve profitability.

A small portion of credits generated in Kenya have also been sold in compliance markets, issued through the Clean Development Mechanism.

The World Bank has previously estimated the cost of eliminating a ton of carbon dioxide to be between $40 and $80 based on the Paris Climate Agreement. Yet, the specific prices paid for these Kenyan credits remain undisclosed.

Carbon Credit Rush: Kenya Emerges as Africa’s Contender

In 2021, several major companies purchased carbon credits from Kenya and Uganda. Delta acquired a total of 1,164 kilotons of Carbon equivalent (KtCO₂e) from both countries, while Netflix and BHP purchased 699 and 200 KtCO₂e from Kenya alone.

In 2022, 11 million VCM credits were issued to Kenya, making it the second-largest issuer of carbon credits in Africa after the Democratic Republic of the Congo, which issued 24 million credits.

Zambia, Uganda, and Malawi issued 4, 3, and 3 million credits, respectively.

The call for carbon credits as a significant revenue source for Kenya comes amid growing awareness of the environmental impact of industries such as fossil fuels, agriculture, fashion, and transportation. President William Ruto has been advocating for carbon credits to mitigate emissions and generate income for the country.

At the 28th United Nations Climate Summit (COP28) held in Dubai in December last year, Kenya joined other nations in emphasizing the importance of carbon markets as complementary to emission reduction efforts. The countries stressed the need for transparency and high-integrity standards to maximize the effectiveness of these markets.

In response to this, the Ministry of Environment in Kenya published draft regulations that would regulate the carbon market. Among the proposals is the stipulation that 25% of the revenue generated by private companies from the sale of carbon credits would be directed to the government.

Additionally, the ministry plans to establish a national carbon registry that would serve as a database for all issued or recognized carbon credits. Private companies have to register with this registry and pay a fee to begin accumulating carbon credits.

These measures aim to ensure market accountability and transparency while providing a framework for revenue generation and conservation efforts.

Kenya’s voluntary carbon market is gaining traction among global players, with tech giants and oil companies jumping into the fray. With Africa’s carbon credit potential unlocked, Kenya aims to harness this market to combat climate change and drive sustainable development.