Climate finance for the African continent has taken a notable step forward with the introduction of the African Carbon Markets Initiative (ACMI). This initiative marks a pivotal moment in unlocking the carbon credit potential of the region, aiming to facilitate the availability of climate finance for African nations. By doing so, ACMI endeavors to promote greater access to clean energy and facilitate sustainable development across the continent. Through the implementation of innovative financial mechanisms and the encouragement of investments in low-carbon projects, ACMI seeks to catalyze transformative change and drive progress towards climate resilience and environmental sustainability in Africa.

The recently signed Memorandum of Understanding (MoU) between the Jospong Group of Companies (JGC) and EKI Energy Services signifies a strategic partnership aimed at advancing carbon credit development in Ghana and the broader West African region. This collaborative effort underscores a shared commitment to driving sustainable development and combating climate change by leveraging carbon finance opportunities. With a focused objective of securing a substantial $1 billion in carbon credit financing, the partnership between JGC and EKI Energy Services aims to catalyze significant investments in climate-resilient projects and initiatives across Ghana. Through innovative strategies and synergistic collaboration, this joint endeavor seeks to unlock the immense potential of carbon markets to foster economic growth, promote environmental stewardship, and enhance resilience to climate-related challenges in the region.

Other countries in the region are also ramping up their efforts in developing their carbon credit markets, with Kenya and Nigeria taking the lead.

Africa’s Carbon Quest: 300M Credits Annually by 2030

Championed by a 13-member steering committee comprising African leaders, chief executives, and industry specialists, ACMI aims to broaden the continent’s involvement in voluntary carbon markets. These markets serve as trading platforms, enabling individuals, businesses, and governments to finance projects that contribute to emission reduction.

ACMI aims to mobilize up to $100 billion carbon credits per year by 2050.

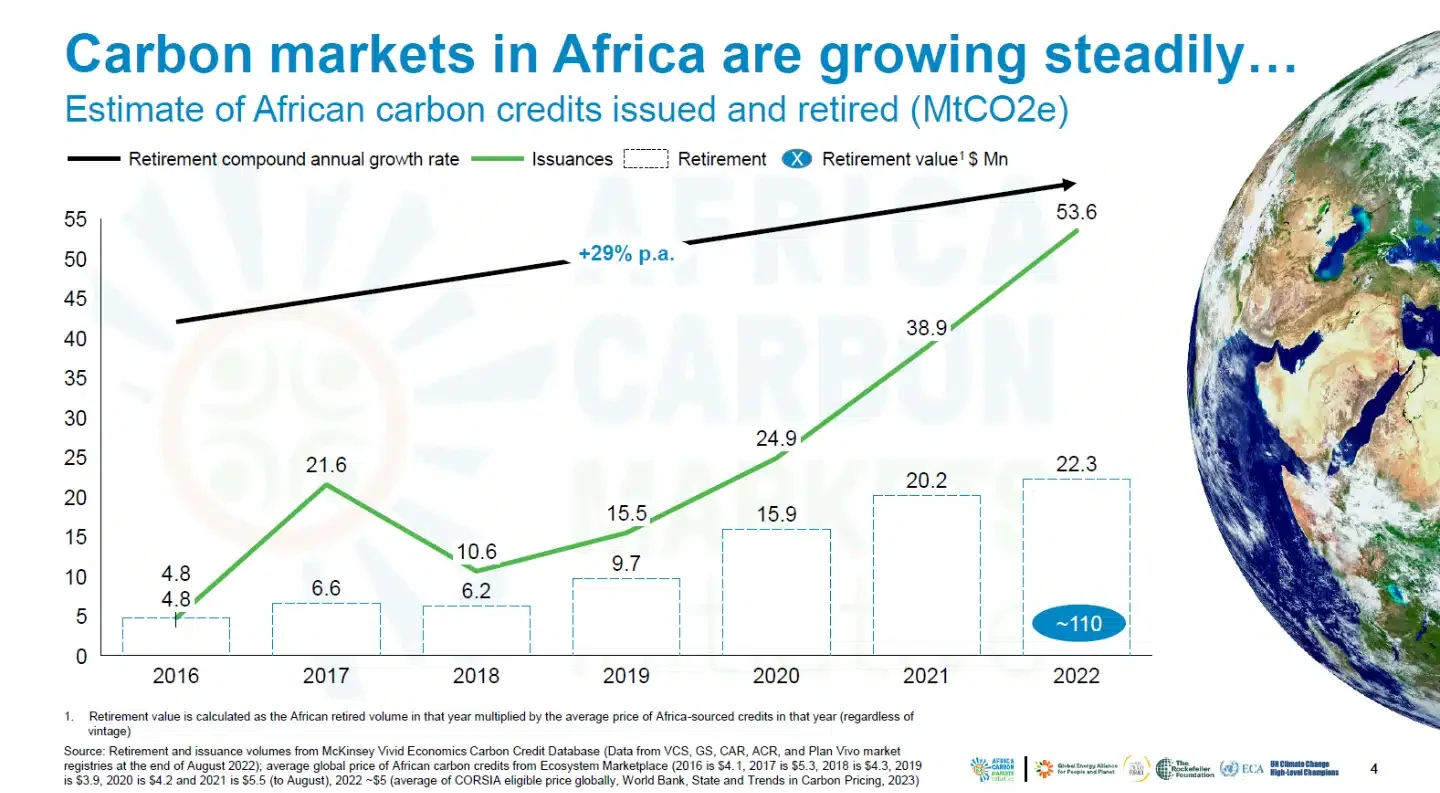

According to estimates, the African carbon markets are growing steadily as shown in the chart below, reaching almost 54 million tonnes of credits issued.

Several African countries, including Kenya and Nigeria have already expressed their intention to collaborate with the market.

The range of climate projects under consideration includes reforestation, renewable energy, carbon-removing agricultural practices, and the implementation of direct air capture technologies. Investors supporting these projects receive carbon credits—certificates enabling them to offset or compensate for their carbon emissions.

The African Carbon Markets Initiative sets an ambitious target of generating 300 million new carbon credits annually by 2030. This goal is equivalent to the total number of credits issued globally in voluntary carbon markets in 2021.

Jospong & EKI’s $1B Deal Sets New Standard

Jospong and EKI Energy’s carbon credit deal is a major development in scaling carbon markets in Ghana. EKI will play a crucial role by providing essential technical assistance for the successful implementation of the project. The partnership covers a 5-year period.

The JGC is a diversified holdings company operating across 14 sectors of the economy, including banking, automobile and equipment. The company’s operations extend to other African countries and Asia.

Jospong’s Chairman, Dr. Joseph Siaw Agyepong, expressed confidence in EKI Energy’s expertise in climate change, saying they’re the ideal partner for the venture. He further noted that:

“We are partnering with EKI Energy because of their experience, so they can hand-hold us and propel strong development in the sector.”

Mr. Manish Dabkara, EKI’s CEO, assured strong support from them in attracting carbon investments for Jospong. The Indian-based carbon credits developer and supplier has an impressive track record of supplying over 200 million carbon offsets.

EKI Energy aims to create 1 billion carbon credits by 2027 and reach net zero by 2030. The Bombay Stock Exchange-listed company brings over 15 years of experience to the collaboration. Operating in 16 countries, EKI is a market leader in climate change, carbon offset solutions, and carbon asset management.

Below is the company’s project portfolio, covering various areas.

Nigeria’s $2.5 Billion Carbon Credit Opportunity

The West African country has been keen in positioning itself in the international carbon market. At COP27 climate summit in 2022, Ghana inked the first-ever voluntary cooperation involving ITMOs (Internationally Transferred Mitigation Outcomes) with Switzerland.

ITMOs, also known as Article 6.2 credits, allow countries to buy or sell carbon credits with other countries.

The ITMO project will help thousands of rice farmers in Ghana to practice sustainable agriculture to reduce methane emissions. Apart from Ghana, other countries in the continent are also committed to develop carbon markets to help mitigate climate change.

Nigeria, for instance, has been acknowledged for its gradual progress in establishing a carbon market framework. President Bola Tinubo announced at the COP28 climate conference that they’re to establish a special committee that will draft a national carbon market strategy. He highlighted the substantial $2.5 billion opportunity for the country within the ACMI.

The draft regulation would include an emissions trading scheme, a carbon registry, and a framework for high-integrity carbon credits. All these would contribute to the broader voluntary carbon market.

Nigeria, committed to achieving net zero carbon emissions by 2060, faces a significant funding challenge to advance its climate strategy.

The recent initiative of the Western African nation will have a pivotal role in addressing the country’s extensive carbon credit potential. Nigeria needs a staggering amount of almost $2 billion to meet its net zero ambition.

Kenya also has taken bold step in its carbon market regulations, particularly amending the country’s Climate Change Act in 2023. The Act introduces a framework for regulating carbon markets and establishes a Designated National Authority responsible for authorizing participants. This authority is also entrusted with maintaining a National Carbon Registry, containing information on carbon credits issued or transferred by Kenya and on carbon credit projects implemented to reduce greenhouse gas emissions.

The Act marks a positive step in creating, participating in, and regulating carbon markets in Kenya. As international investors already engage in various sectors in the country, the Act lays the foundation for future regulations that will provide finer details.

In a bid to tackle climate change challenges, the African nations are actively collaborating and supporting innovative financing. From Ghana’s $1 billion carbon credit deal with EKI Energy to Kenya and Nigeria’s supportive policies, the continent is on its way to drive climate action.